December 2023 REPORT

Brookfield’s Climate Paradox

Climate Pledges vs. Fossil Fuel Reality

Report exposes Brookfield’s fossil fuel investments and emissions reality

Facts do not square with promises touted by Brookfield executive and net-zero advocate Mark Carney

Brookfield portrays itself as a climate-friendly investor, but with over 215 fossil fuel assets emitting nearly 159 million metric tons of CO2e annually, their actions paint a different picture.

Private equity giant Brookfield Corporation’s vast fossil fuel investments undermine its stated commitment to tackle climate change. With over $850 billion in assets under management—and despite a declared goal of achieving net-zero emissions by 2050 or sooner—the Canadian investment firm finances emissions that raise serious questions about the credibility of its climate goals.

The report highlights a stark discrepancy between Brookfield’s reported emissions and its actual carbon footprint. Its current fossil fuel investments emit nearly 159 million metric tons of CO2 equivalent (CO2e) a year, much of that through its ownership of Oaktree Capital, a private equity firm with $183 billion in assets. This emissions figure is nearly 14 times higher than the figures Brookfield discloses in its most recent sustainability report and greater than the CO2 emissions produced by burning 178 billion pounds of coal.

Fact: Brookfield’s 2022 environmental ranking was a failing ‘D’ grade.

Brookfield’s Climate Paradox: Climate Pledges vs. Fossil Fuel Reality also examines the role of Brookfield Asset Management Chair and Head of Transition Investing Mark Carney, a prominent former central banker. Despite being a high-profile advocate for financial sector commitments to net-zero targets, including acting as Co-Chair of the Glasgow Financial Alliance for Net Zero (GFANZ), Carney oversees investment decisions that starkly contrast with sustainable and transparent practices.

Report

Brookfield’s Climate Paradox: Climate Pledges vs. Fossil Fuel Reality

Authored by: Alex Hurley, Amanda Mendoza, Alyssa Moore, and Oscar Valdés Viera

I. Introduction

Canada-based Brookfield Corporation (together with its asset management arm, Brookfield Asset Management Ltd., and other subsidiaries and affiliates, “Brookfield”)[1] is an investment powerhouse with over $850 billion in assets under management (AUM) spanning virtually all industries across the global economy.[2]

Brookfield, a self-proclaimed “leader in decarbonization”[3] and a signatory to an alphabet soup of climate frameworks and organizations,[4] portrays itself as a climate-friendly investor with “sustainability in the fabric of [its] DNA,”[5] and has committed to reaching net-zero emissions across all of its assets under management by 2050 “or sooner.”[6]

However, this net-zero commitment uses an incomplete accounting of Scope 3 emissions,[7] the emissions category which counts those from investments, by far the largest component of the carbon footprint for financial institutions.[8] And, despite its public climate commitments and pledges and a sizable renewable energy portfolio, Brookfield continues to invest heavily in fossil fuel assets through its web of corporate affiliates—including through a fund supported by its “Renewable”-labeled platform.[9]

Major private equity firms like Brookfield can undercount their emissions and undermine their own commitments since they face less public pressure and regulatory oversight than other financial institutions such as banks, allowing them to greenwash their operations while doubling-down on fossil fuel assets.[10] Most of Brookfield’s investments follow the private equity model of raising private funds through which they acquire other companies (or a controlling stake in other companies), creating byzantine ownership structures that impede transparency, and holding these companies for a short period of time before selling them again or taking them public.[11] The private equity business model siphons profits and revenues out of real world assets and can insulate the private equity managers from responsibility for repaying the heavy debt loads imposed on target companies; from addressing the costs of financial mismanagement; and from legal liability for negligence or other risks. These investment practices use loopholes, exemptions, and gray areas in the regulatory landscape to largely escape reporting requirements, tough oversight, and accountability.[12]

“Brookfield embodies the definition of greenwashing.”

– Amanda Mendoza, PESP

Within this context, Mark Carney, Chair of Brookfield Asset Management and Head of Transition Investing, is central to Brookfield’s branding as a responsible green investor.[13] Brookfield advertised Mr. Carney’s recruitment in 2020 as “another step in Brookfield’s longstanding commitment to sustainability.”[14] Mr. Carney champions net-zero commitments and renewable energy investments from financial institutions as the United Nations Special Envoy for Climate Action and Finance and as the Co-Chair for the Glasgow Finance Alliance for Net Zero (GFANZ).[15] Through GFANZ, Mr. Carney has orchestrated a rally of financial sector commitments towards reaching net zero. However, by setting targets without committing to clear emissions reductions or a move away from fossil fuels altogether, GFANZ is largely symbolic.[16]

The investment decisions his firm continues to make are glaringly out of step with the ideas of sustainable transparency that Carney espouses. Previous studies, such as UNITE HERE’s “Brookfield Climate Reality Check” analysis, have detailed significant inadequacies in Brookfield’s climate-related announcements, commitments, and emissions reduction claims.[17] This report complements such analyses by uncovering Brookfield’s full energy portfolio and accounting for full supply emissions for these holdings. Our findings reveal that Brookfield, including through its partnership with Oaktree, has amassed a “budding oil and gas empire”[18] spanning every sector through the fossil fuels supply chain through its persistent fossil fuel investments in at least 215 different assets through 31 different portfolio companies—from oil and gas drilling and extraction, to dangerous fossil fuel storage and transportation, to dirty power generation.

The raw data, additional summary information, and the methodology for the following analysis is accessible by following these links: raw data, methodology.

The combined current fossil fuel investments of Brookfield and Oaktree emit an estimated 159 million metric tons (mt) of CO2 equivalent (CO2e) annually.

This is an order of magnitude more than the 11.8 million mt CO2e disclosed in Brookfield’s sustainability reports.

II. Brookfield’s Extensive Fossil Fuel Portfolio: Size and Emissions

We estimate that the current fossil fuel portfolio of Brookfield and its subsidiaries, including Oaktree, emits nearly 159 million metric tons (mt) of CO2 equivalent (CO2e) per year across all asset classes. To offset this single year’s worth of emissions, one would need to plant over two and a half billion trees and let them grow for 10 years.[19] Over the 10 to 12 year average lifespan of a Brookfield fund,[20] such emissions are the equivalent of what scientists have dubbed “carbon bomb” levels of greenhouse gas emissions.[21] The estimate is nearly 14 times larger than the emissions of 11.8 million mt CO2e that Brookfield disclosed in its most recent sustainability report.[22]

“After carefully examining Brookfield’s fossil fuel portfolio, it stretches the limits of credulity to view these assets as part of an orderly clean energy transition.”

– Alex Hurley, GEM.

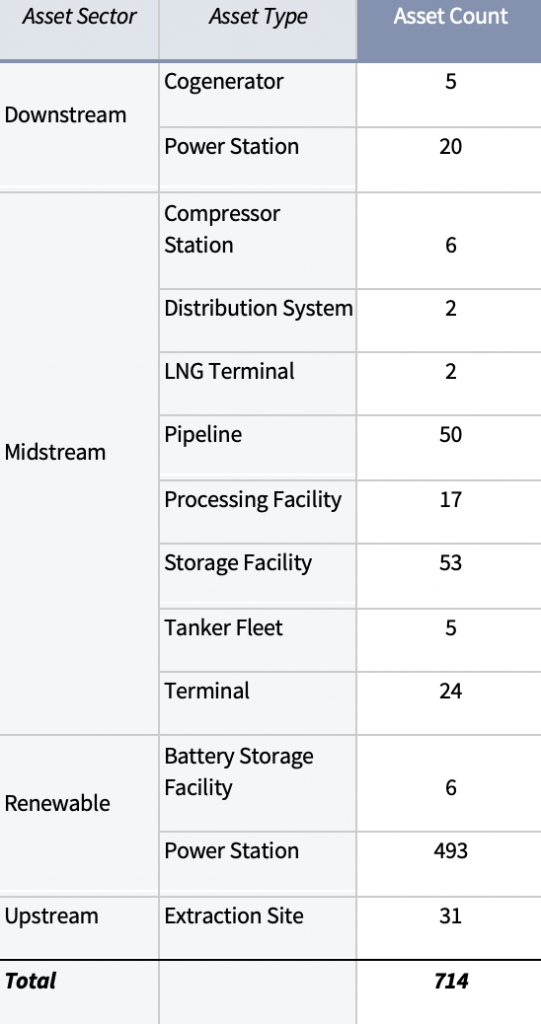

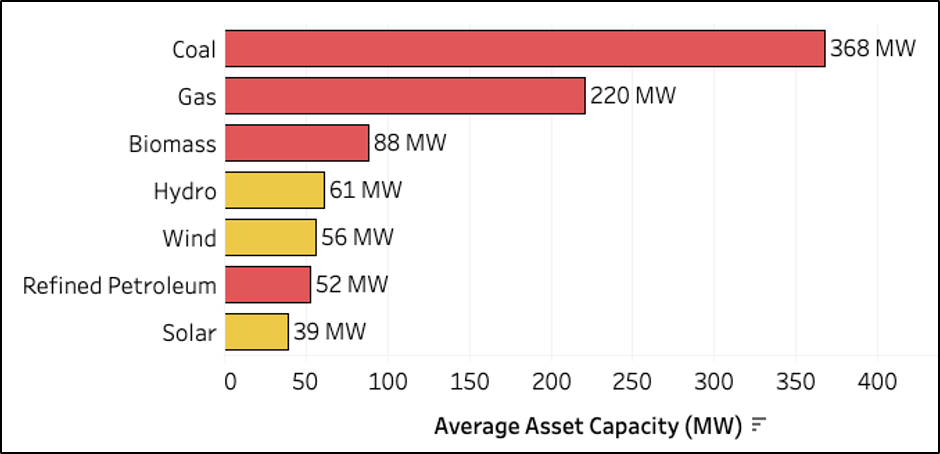

Brookfield and Oaktree are invested widely across the energy sector in over 700 different assets across all asset types and fuel sources (see “Portfolio company verification” section of Methodology and Research Process below). The full range of asset types are listed in Table 1 below. The current portfolio includes almost 500 renewable energy-based assets, across solar, wind, and hydro sources. The average capacity for these energy-generating assets is approximately 50 megawatts (MW), while the average capacity for Brookfield’s fossil fuel power plants is approximately 235 MW, including several that are nearly 1,000 MW in size (see Figure 1). Of these fossil-fuel power plants, 75 percent of the capacity is powered by fossil gas, followed by 16 percent by coal, and roughly four percent by biomass and petroleum each.

Table 1. Current Brookfield Energy Assets, by Type

Figure 1. Average Capacity of Brookfield’s Current Electricity Generators by Fuel Type

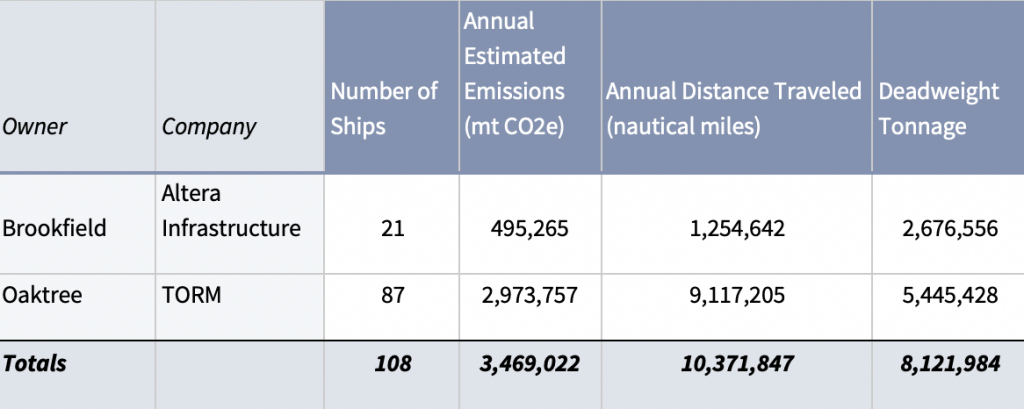

Noteworthy midstream assets in the portfolio include the Sabine Pass and Cove Point LNG terminals located on the Gulf Coast of the United States,[23] the Dalrymple Bay Coal Terminal in northeast Australia,[24] a massive network of fossil gas pipelines in the United Arab Emirates,[25] and over one hundred oil and gas tankers for ocean-based shipping.[26]

Case Study

TORM Helene

Deadweight tonnage: The TORM Helene, a two-year-old long-range oil tanker, has a carrying capacity of 115,575 deadweight tons.[27]

Annual Travel: In 2022 alone, the TORM Helene traveled more than 133,000 nautical miles, with ports of call including Portugal, the United Arab Emirates, and Japan.[28] For reference, this would be equivalent to circumnavigating the Earth more than six times in a single year.[29]

Emissions: 2023 emissions from burning fuel from this single oil tanker for ocean-going travel total an estimated 79,000 mt CO2e—roughly equivalent to the emissions of more than 17,000 cars.[30] However, the Helene is just one of more than 80 tankers owned by Brookfield and Oaktree via the Denmark-based fossil tanker company TORM,[31] in addition to another 21 ships operated by Altera Infrastructure.[32] In total, we estimate that Brookfield and Oaktree’s fleet of oil tankers emit nearly 3.5 million mt CO2e per year.

Table 2. Brookfield and Oaktree’s Current Fleet of Tankers

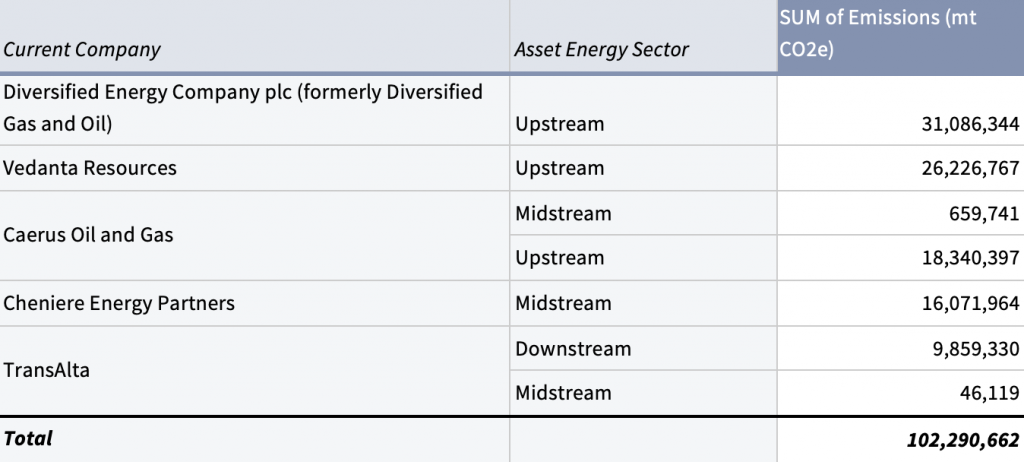

The top three portfolio companies by estimated emissions footprint of Brookfield’s and Oaktree’s portfolios are all involved with upstream assets. These companies are Diversified Energy Company, Vedanta Resources, and Caerus Oil and Gas. Together, these three companies account for approximately 76 million mt CO2e, or about 48 percent of the total Brookfield/Oaktree annual estimated emissions footprint of 159 million mt CO2e/year (see Table 3).

Table 3. Top Five Current Portfolio Companies by Estimated 2023 Emissions

Brookfield and Oaktree’s current upstream oil and gas assets have an estimated extraction capacity of 177 million barrels of oil equivalent per year. The extraction and ultimate use of this amount of oil and gas alone is estimated to release 89 million mt of CO2e per year.

Brookfield and Oaktree’s current upstream oil and gas assets have an estimated extraction capacity of 177 million barrels of oil equivalent per year.

The extraction and ultimate use of this amount of oil and gas alone is estimated to release 89 million mt of CO2e per year.

Our findings reveal that Brookfield, including through its partnership with Oaktree, has amassed a “budding oil and gas empire” spanning every sector through the fossil fuels supply chain through its persistent fossil fuel investments in at least 215 different assets through 31 different portfolio companies.

III. Oaktree Capital Management Adds to the Scale of the Problem

In 2019, Brookfield acquired 61 percent of the business of Oaktree Capital Management, a private equity firm and asset manager currently with $16 billion in assets under management.[33] Oaktree has 11 fossil fuel companies in its portfolio, with six of them oil and gas drilling and exploration outfits.

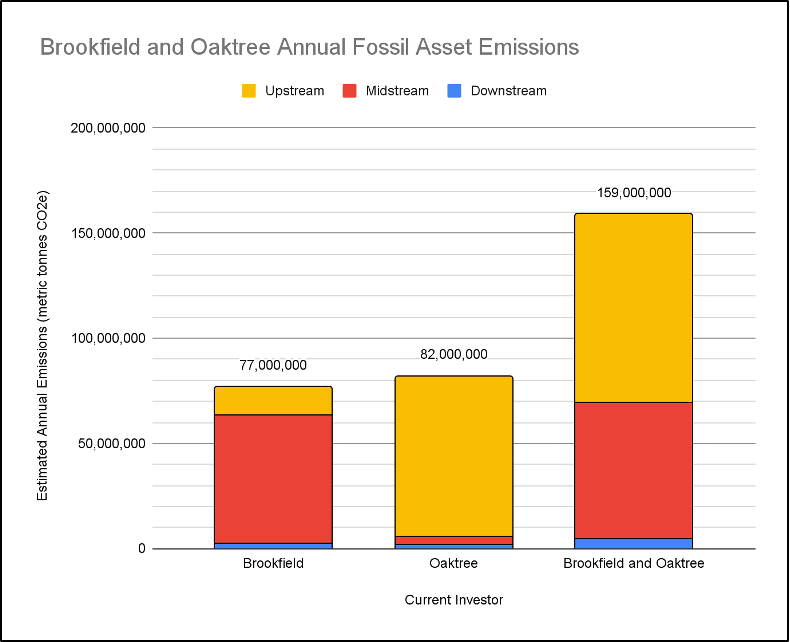

Oaktree’s current assets emit an estimated 82 million mt CO2e per year, with nearly all—76 million mt CO2e—from the upstream sector. This exceeds the total estimated annual emissions of fossil assets owned by Brookfield’s other subsidiaries, at 77 million mt CO2e across the entire fossil value chain (upstream, midstream, and downstream). The largest portion of Brookfield’s emissions come from its sizable midstream portfolio, amounting to 61 million mt CO2e. Only about 5 million mt CO2e per year come from the downstream sector across both investors (See Figure 2).

Figure 2. Emissions by Brookfield and Oaktree’s Fossil Fuel Assets in 2023

Though Oaktree’s emissions outstrip Brookfield’s own, Brookfield has excluded Oaktree’s activities and emissions from its 2021 and 2022 Sustainability Reports, noting this glaring omission in only a footnote.[34] At the same time, Brookfield continues to count its share of Oaktree’s holdings within its overall assets under management and its leadership described Oaktree as a Brookfield “platform” on a recent investor call.[35] Brookfield also takes credit for the funds raised for Oaktree.[36] Oaktree does have its own Environmental, Social, and Corporate Governance (ESG) policies,[37] though the firm’s 2022 ESG report made no commitment to transition away from fossil fuels or even to reduce its greenhouse gas emissions,[38] which is inconsistent with Brookfield’s net-zero commitments.

“Brookfield follows a trend among major private equity firms of undercounting their planet-warming emissions and placing polluting assets behind a labyrinth of corporate structures and shell companies.”

– Oscar Valdés Viera, AFREF

Caerus Oil & Gas (Caerus), an Oaktree portfolio company, ranked as the ninth highest greenhouse gas emitter and third highest methane polluter—outpaced only by giants Hilcorp and ExxonMobil in this metric—among the top 100 oil and gas producers in the US, according to a 2023 report by Ceres and the Clean Air Task Force.[39] Caerus, which has the dirtiest methane operations by intensity,[40] currently operates 7,400 wells in the Uinta and Piceance basins in Utah and Colorado and has acquired additional land with plans to develop over 5,000 new wells.[41] Caerus expanded its dirty operations by acquiring assets from publicly-traded companies and effectively transferring operations and emissions into the opaque world of private equity reporting.[42]

IV. An International Footprint with Significant North American Assets

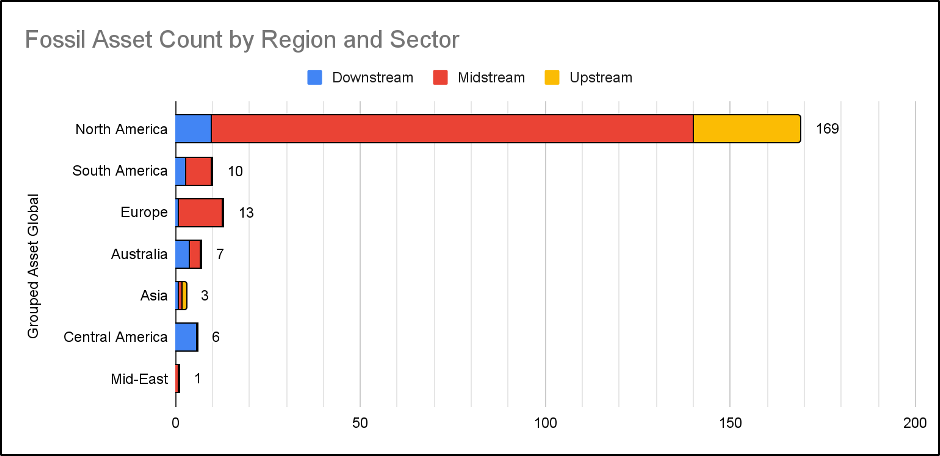

Brookfield and Oaktree are invested in fossil fuel assets based in 16 different countries. Most fossil assets owned by Brookfield and Oaktree are located in North America, with the United States as the top asset location, followed by Canada (see Figure 3). Almost all of the upstream assets and a substantial portion of the midstream assets are located in North America.

Figure 3. Current Fossil Fuel Asset Count by Region and Sector

One noteworthy international investment is Brookfield’s minority stake in Galaxy Pipeline with interests in assets located in the United Arab Emirates.

Case Study

ADNOC Pipelines

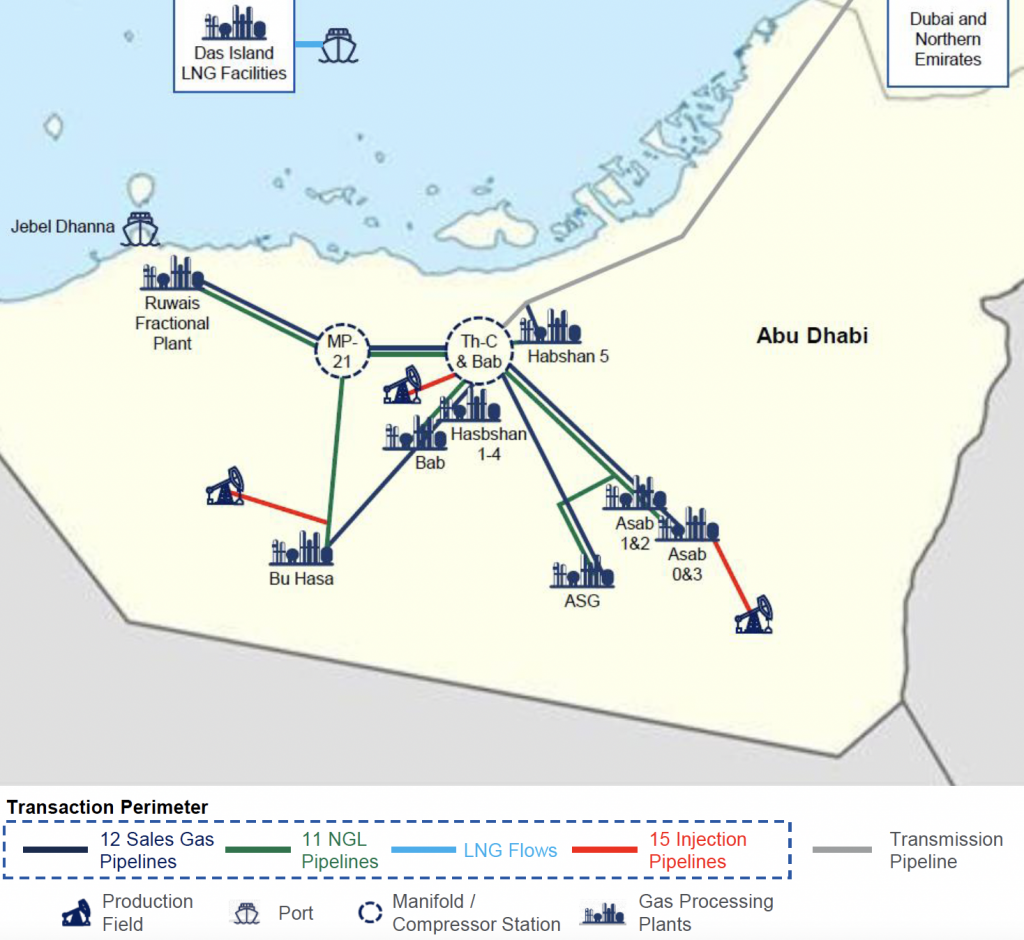

In July 2020, Brookfield and other investors purchased a 47.7 percent stake in ADNOC Gas Pipeline Assets, a set of 38 gas pipelines operated by the Abu Dhabi National Oil Company (ADNOC).[43] Through the $10.1 billion deal, Brookfield, Global Infrastructure Partners and the other investors acquired lease rights to the 38 pipelines, covering roughly 600 miles across the United Arab Emirates, for 20 years (see Image 2).[44]

The estimated emissions from these pipelines alone total more than 9.5 million mt CO2e per year—the equivalent of burning more than 4.8 million mt of coal.[45]

Image 2. Galaxy Gas Pipeline Network Overview.[46]

Source: Galaxy Pipelines Investor Presentation, October 2020.

Additionally, Brookfield’s involvement with ADNOC itself raises significant climate and ethical concerns. ADNOC has the single largest “net zero-busting” expansion plans of any company in the world, according to analysis of 2023 data published by the Global Oil and Gas Exit List (GOGEL).[47] In other words, ADNOC has the world’s largest oil and gas expansion overshoot—more than double that of its next-ranked competitors—based on a transition path by the International Energy Agency (IEA) to achieve net zero emissions and keep global warming below 1.5 degrees Celsius.[48]

ADNOC itself claims it will reach net zero methane emissions by 2030 and net zero emissions overall by 2045,[49] but its activities tell a different story. Estimates suggest that ADNOC will emit more than 11 billion mt of greenhouse gasses—more than the annual emissions of China—in the next 25 years.[50] For the next ten years, ADNOC plans to spend more than $1 billion per month on oil and gas production alone—over seven times the amount the company has earmarked for “low-carbon” solutions.[51] In total, analysis suggests that ADNOC plans to spend at least $150 billion on new oil and gas production over the next decade, despite warnings from the United Nations and IEA that “no new additional oil and gas production is compatible with the Paris Agreement temperature goal of limiting heating to 1.5C.”[52] Recent analysis by Global Witness suggests that it would take ADNOC a whopping 343 years to capture the CO2 emissions it produces in the next six years alone.[53]

V. Conclusion

Brookfield and Oaktree’s combined estimated annual emissions, 159 million metric tons (mt) of CO2 equivalent (CO2e) per year, come from over 200 fossil fuel assets currently owned through 31 portfolio companies. These comprise a significant number of highly polluting upstream and midstream assets, including thousands of oil and gas drilling wells, a myriad of LNG terminals and pipelines, and over 100 oil tankers. While Brookfield fails to report the majority of emissions, including emissions from its upstream-heavy Oaktree affiliate, a thorough accounting of their fossil fuel exposure shows an investment strategy that places investors, the public, the Earth, and our sustainable futures all at risk, and exposes the disingenuous nature of its claims to sustainability and net-zero commitment.

Analysis is developed jointly by researchers from Americans for Financial Reform Education Fund, Global Energy Monitor, and the Private Equity Stakeholder Project.

About Americans for Financial Reform Education Fund

Americans for Financial Reform Education Fund (AFREF) is a nonpartisan, nonprofit coalition of more than 200 civil rights, community-based, consumer, labor, business, investor, faith-based and civic groups, along with individual experts. AFREF fights to eliminate inequity and systemic racism in the financial system in service of a just and sustainable economy. Follow AFREF at ourfinancialsecurity.org and on Twitter @RealBankReform.

About Global Energy Monitor

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape, creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system. Users of GEM’s data and reports include the International Energy Agency, United Nations Environment Programme, the World Bank, and the Bloomberg Global Coal Countdown. Follow GEM at globalenergymonitor.org and on Twitter @GlobalEnergyMon.

About the Private Equity Stakeholder Project

The Private Equity Stakeholder Project (PESP) is a nonprofit organization with a mission to identify, engage, and connect stakeholders affected by private equity with the goal of engaging investors and empowering communities, working families, and others impacted by private equity investments. Follow PESP at pestakeholder.org and on Twitter @PEstakeholder.