Brookfield is a large private equity infrastructure asset manager with a trillion dollars in AUM as of August 2024, and has held a majority stake in Oaktree Capital Management since 2019.

As of the end of July 2024, Brookfield and Oaktree collectively owned 29 fossil fuel companies, representing 50 percent of the energy companies in its portfolio. Brookfield met 17 percent of the Climate Demands and received a D grade in the 2024 scorecard.

Brookfield has committed to being net zero by 2050. The firm said it “measured and tracked emissions across [its] business groups for several years … informed by the GHG Protocol and Partnership for Carbon Accounting Financials (PCAF),” and that it has agreed to “set an interim target for a portion of [its] AUM with the ambition to reduce emissions by 50 [percent] by 2030,” and is a signatory to the Glasgow Alliance for Net Zero [GFANZ]. Despite its public commitment to net-zero emissions, Brookfield continues to actively hold fossil fuel investments, including the nearly seven billion dollar buyout of Canada’s fourth-largest midstream company, Inter Pipeline, in 2021.

Read the Full Report and View 2024 Scorecard

In 2020, Brookfield acquired a 40 percent stake in an LNG export terminal in Louisiana for seven billion dollars, (which is co-owned by the country’s largest LNG producer, Cheniere Energy). Although Brookfield has made a commitment to net zero by 2050, it appears that it will continue to own and operate a large amount of fossil fuel infrastructure. In the company’s 2023 Sustainability Report, Brookfield discloses a limited emissions analysis of “controlled portfolio companies” Scope 1 and 2 emissions of over 9 million tons of CO2e in the reporting period, compared to PECR findings that Brookfield and Oaktree’s portfolio emits an order of magnitude more emissions, over 211 million tons of CO2e per year. Brookfield’s double standards underscore the need for private equity firms to commit to a fossil-free portfolio sooner, rather than by 2050, which is nearly a generation away.

50%

Percent of Fossil Fuel Companies In Energy Portfolio

29

Number of Fossil Fuel Companies

173 million

Emissions from Upstream Operations

13.5 million

Emissions from LNG Terminals

25.2 million

Emissions from Coal-fired Power Plants

211.8 million

Total Est. Annual Emissions (upstream, LNG, coal)

17%

Percent of Demands Met

D

2024 Scorecard Grade

2023 REPORT

Brookfield’s Climate Paradox: Climate Pledges vs. Fossil Fuel Reality

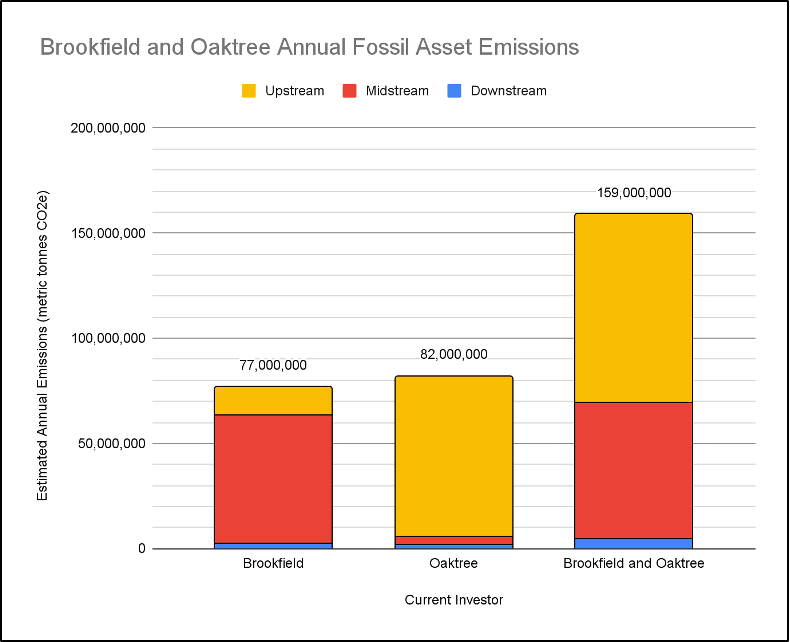

This report highlights a stark discrepancy between Brookfield’s reported emissions and its actual carbon footprint. Its current fossil fuel investments emit nearly 159 million metric tons of CO2 equivalent (CO2e) a year, much of that through its ownership of Oaktree Capital, a private equity firm with $183 billion in assets. This emissions figure is nearly 14 times higher than the figures Brookfield discloses in its most recent sustainability report.

The report is written by the Private Equity Stakeholder Project, Americans for Financial Reform Education Fund, and Global Energy Monitor.

2023 REPORT

Brookfield’s Climate Paradox: Climate Pledges vs. Fossil Fuel Reality

Updated: December 5, 2023