The Carlyle Group and its subsidiary, NGP Energy Capital, have one of the worst rankings amongst the 21 firms in the 2024 scorecard, scoring a D.

Carlyle is one of the world’s largest alternative asset managers, with $435 billion in AUM as of August 2024. Led by CEO Harvey Schwartz, the Washington DC-based firm is one of the highest private equity emitters, holding 23 fossil fuel companies, representing 77 percent of its energy portfolio, as of the end of July 2024. Despite Carlyle’s public commitment towards net zero by 2050 in its 2021 TCFD report, Carlyle’s investments in fossil fuels have dumped at least 215.5 million metric tons of CO2e into the atmosphere annually.

Carlyle has no public fossil fuel policy,114 but the firm helped launch the ESG Data Convergence Initiative, with CalPERS, a major institutional investor, to set standardized voluntary reporting within the private equity industry on a few Environmental, Social, and Governance (ESG) metrics. Despite Carlyle’s work on that project, the firm has no publicly announced plans to stop its investments in fossil fuels.

Read the Full Report and View 2024 Scorecard

In 2024, Carlyle announced plans to build an oil and gas company focused on the Mediterranean, with a $945 million acquisition of projects in Italy, Egypt, and Croatia. Carlyle’s 2021 TCFD and its 2023 ESG reports did not include NGP in the scope of its reporting. These omissions should concern investors and the public because Carlyle’s recent 2024 second-quarter earnings report indicates that around three percent of the firm’s revenue and 20 percent of the firm’s profit for the first half of 2024 came from NGP.

77%

Percent of Fossil Fuel Companies In Energy Portfolio

23

Number of Fossil Fuel Companies

215.5 million

Emissions from Upstream Operations

0

Emissions from LNG Terminals

0

Emissions from Coal-fired Power Plants

215.5 million

Total Est. Annual Emissions (upstream, LNG, coal)

11%

Percent of Demands Met

D

2024 Scorecard Grade

2023 REPORT

The Carlyle Group’s Hidden Climate Impact

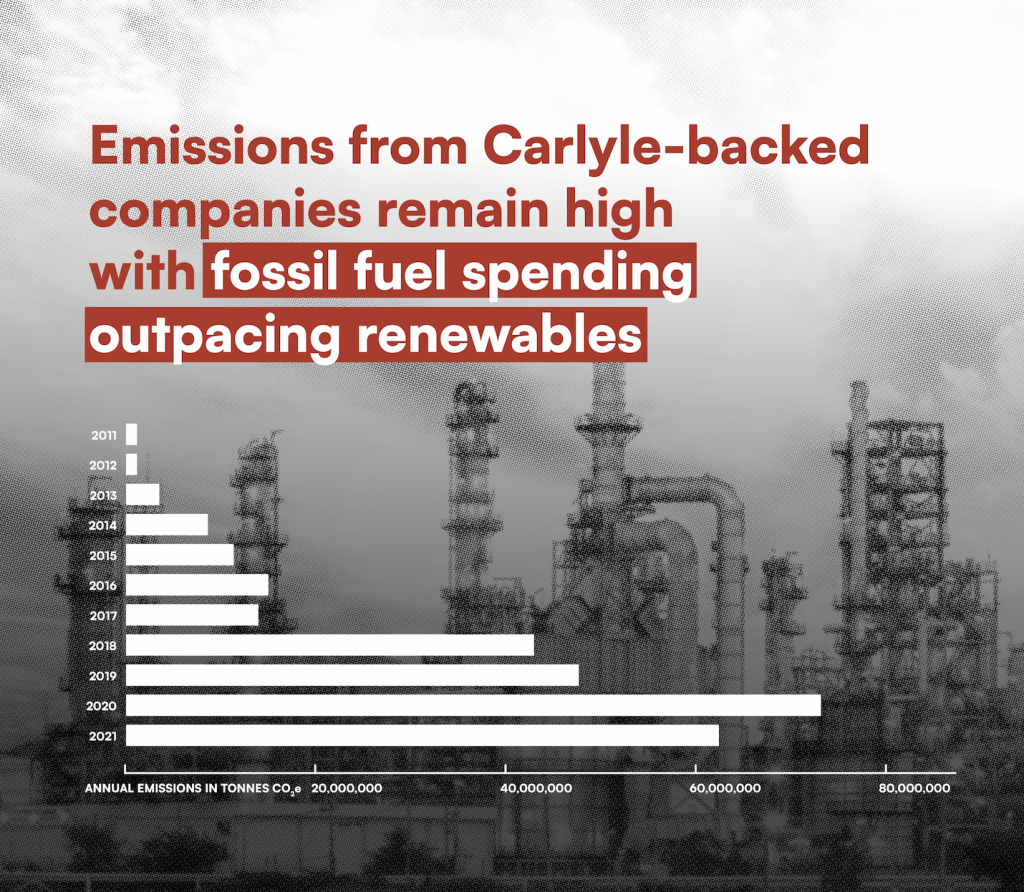

As one of the world’s largest private equity firms, The Carlyle Group invests heavily in fossil fuels, despite the urgent need to transition to renewable energy. For every $1 invested in renewable energy, Carlyle invests $16 in fossil fuels, exacerbating the global climate crisis.

Carlyle’s energy investments from 2011-2021 is heavily skewed toward fossil fuels with $22.4 billion in carbon-based energy and only $1.4 billion in renewables. This resulted in an estimated 277 million metric tons of CO2 emissions, which would take 4.6 billion newly planted trees ten years to remove.

Learn more about the financial and reputational risks of Carlyle’s fossil fuel investments and their impact on the planet and communities.

2023 REPORT

Carlyle Group’s Hidden Climate Impact

Updated: April 27, 2023

2022 REPORT

Carlyle’s Upstream Investments at Risk from the Energy Transition

This report finds Carlyle’s portfolio has been relatively more exposed to transition risk than almost all of the oil majors. Its net-zero target for its portfolio companies is not aligned with the goals of the Paris Agreement, highlighting increased risk for investors and the need for stronger transition planning.