A Look at Private Equity Transition Funds: Energy Innovation or Greenwashing?

How False Solutions Propel the Climate Crisis

False solutions, technologies and energy sources billed as “green” but don’t effectively move us towards a renewable energy transition, create confusion for investors and fiduciaries who genuinely wish to insulate investment portfolios from climate-related financial risk and transition away from fossil fuels.

Recently, the term “false solutions” has gained momentum to call out greenwashing or other potentially ineffective solutions that divert resources away from “true solutions” to decarbonizing our energy systems. A new report by the Private Equity Risks Consortium looks specifically at private equity’s role in advancing false solutions and examples of how these false solutions may end up in their transition portfolios. The report then dives into case studies of six false solutions industries, carbon capture technologies, carbon trading, gas certification, hydrogen, biomass, and renewable natural gas, with examples of private equity investments in those industries. Specific risks are outlined and resources for institutional investors are provided to strengthen investors’ due diligence processes. With adequate due diligence, investors can play a key role in ensuring that energy transition funds and climate solutions truly address climate based financial risks – solutions that reduce emissions and support the retirement of fossil fuels.

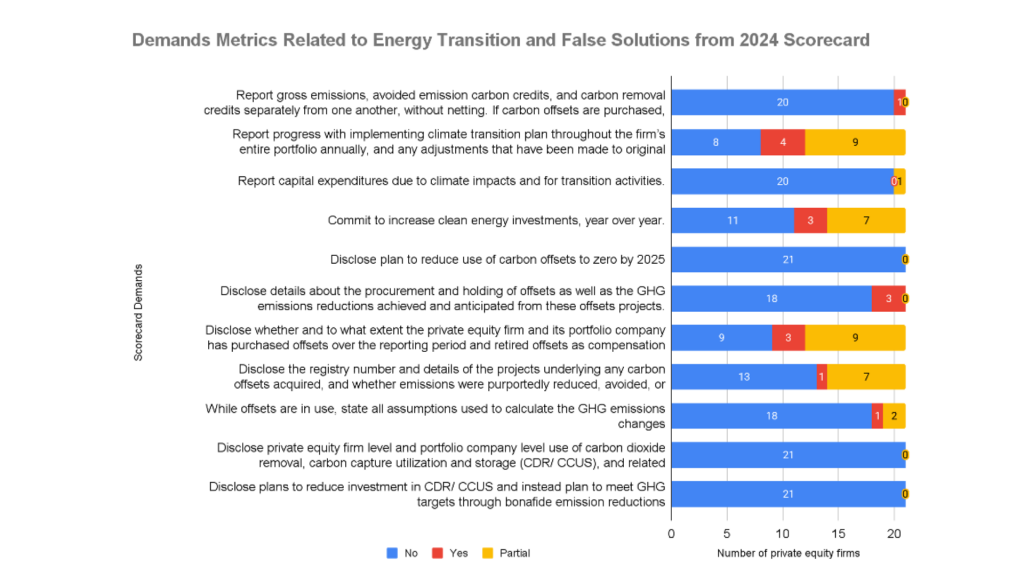

The Private Equity Climate Risk Consortium’s 2024 Climate Risk Scorecard outlined a series of demands and researched the extent to which 21 of the top private equity firms are meeting those standards.[1] Eleven of the demands relating to energy transition initiatives and participation in false solutions industries were examined to see the extent to which 21 of the top private equity firms are meeting those standards specifically. No more than four private equity firms have met any individual demand, as of October 2024.

Simultaneously, private investments in transition funds and assets are seeing increased capital expenditures. Over 890 private infrastructure vehicles containing some energy transition investment closed from 2014 through the first half of 2024. The lack of clear commitments from the private equity industry to properly disclose investments in false solutions industries and emissions reduction progress, and increased activity in energy transition fundraising creates an opaque understanding of what’s really going on in private markets energy transition investing, despite the market potentially growing. Without clear disclosure and accountability measures, it’s difficult to tell to what extent these funds are investing in true solutions, false solutions, or simply continuing to invest in fossil fuels despite branding a fund as “energy transition”.

Risks to Institutional Investors with Exposure to False Solutions and Resources

Due diligence is a crucial component of managing any investment portfolio. The following questions aim to be a resource for institutional investors looking to commit capital to private equity, infrastructure, or real assets managers with energy transition investments. General partner responses to these questions could hopefully provide investors with important information regarding the effectiveness of the industries in their energy transition portfolios.

Questions for Investors About Financial Risks of False Solutions Industries

- What is the proposed timeline for the project to be operational? How does that align with timelines for portfolio-wide emissions reductions?

- Has there been independent, non-industry related, analysis of the carbon emissions reductions associated with this technology

- What is the market outlook for this industry? Does the project have established supply and demand/ buyers at scale?

- What are the regulations pertaining to this technology where it is located? Locally and nationally?

Risks Alignment of energy transition funds with a 1.5 degree warming scenario/climate change mitigation goals

- When considering an investment in an energy transition fund, scrutinize what the GPs target industries are for investment of those funds. Do those industries support or prop up existing oil and gas operations, making fossil fuels more difficult to exit?

- What transparency around the effectiveness of emissions reductions or renewable energy generation are GPs willing to provide to LPs for their own reporting of climate goals

- To what extent does a particular transition fund aim to focus on false solutions industries versus renewable energy generation?

- How do investments in energy transition funds align with the existing Climate Standards for Private Markets Investors?

This report examines the role of private equity in advancing false solutions to the climate crisis, specifically focusing on investments labeled as part of the energy transition that may perpetuate reliance on fossil fuels. These behaviors of major private equity firms reveal a lack of transparency and accountability in their energy transition investments. The report points to instances of greenwashing, such as firms promoting energy transition funds and investments containing false solutions industries that have uncertain benefits or rely on continued fossil fuel production. These investments create risks for institutional investors whose fund commitments are locked into these long-term private equity investments. It concludes with a set of due diligence questions for investors to better assess the true climate impact of energy transition funds and ensure their investments align with genuine decarbonization goals.

To read the full report, click here.